BlackRock Bitcoin ETF attracts no inflows for 4th consecutive day

The post BlackRock Bitcoin ETF attracts no inflows for 4th consecutive day appeared on BitcoinEthereumNews.com. Following last week’s digital asset investment product sentiment, spot Bitcoin ETFs again saw capital exits on April 29. According to SoSoValue, 11 U.S. spot Bitcoin (BTC) ETFs recorded $51.53 million in cumulative single-day outflows. Grayscale’s GBTC fund was upstaged by another player in a rare occurrence. While GBTC noted $24.66 million in exits, investors withdrew $31.34 million from ARK 21Shares’ BTC ETF. Fidelity’s spot Bitcoin ETF also saw outflows of $6.85 million. Meanwhile, five issuers, including BlackRock’s IBIT fund, did not attract inflows. BlackRock has leapfrogged Grayscale as the new spot BTC ETF market leader and commands only $2 billion less than GBTC despite debuting over 10 years after the incumbent. The latest trading data marked a four-day streak of no inflows for BlackRock’s fund. This came after 71 days of daily inflows, which propelled IBIT above competing funds. Furthermore, ETF expert Eric Balchunas noted that the trend was not unusual on Wall Street. Totally normal, for example 78% of all ETFs saw $0 inflow yest. Extreme eg: $EEM has reported $0 inflows for like 150 days in a row while trading $80b worth of shares. Just means naturals balanced out or inflows and outflows were equal — Eric Balchunas (@EricBalchunas) April 25, 2024 Bitcoin undeterred by spot ETF outflow, post-halving price lull Per CoinMarketCap, Bitcoin traded under $61,000 at press time and had declined over 12% in the past month due to a market correction leading up to the halving. The broader cryptocurrency market has correlated with BTC price action, and altcoin valuations have stalled, with the total crypto market cap plunging below $2.3 trillion. Sideways crypto movement is not new following a halving, but speculations about the market’s status abound. Speaking with crypto.news, Storm Labs CEO Sunil Srivatsa said the bull run is on. “General consensus is that we’ve entered another bull…

The post BlackRock Bitcoin ETF attracts no inflows for 4th consecutive day appeared on BitcoinEthereumNews.com.

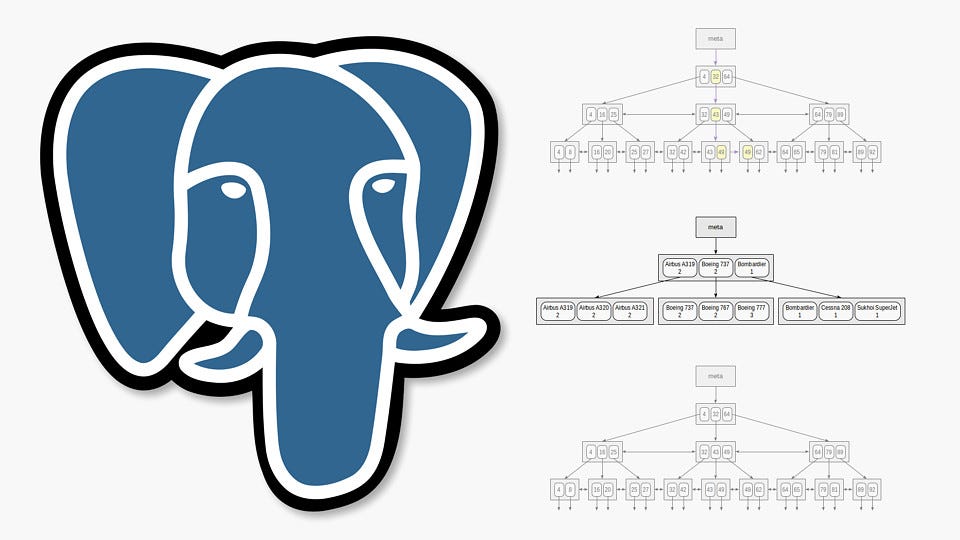

Following last week’s digital asset investment product sentiment, spot Bitcoin ETFs again saw capital exits on April 29. According to SoSoValue, 11 U.S. spot Bitcoin (BTC) ETFs recorded $51.53 million in cumulative single-day outflows. Grayscale’s GBTC fund was upstaged by another player in a rare occurrence. While GBTC noted $24.66 million in exits, investors withdrew $31.34 million from ARK 21Shares’ BTC ETF. Fidelity’s spot Bitcoin ETF also saw outflows of $6.85 million. Meanwhile, five issuers, including BlackRock’s IBIT fund, did not attract inflows. BlackRock has leapfrogged Grayscale as the new spot BTC ETF market leader and commands only $2 billion less than GBTC despite debuting over 10 years after the incumbent. The latest trading data marked a four-day streak of no inflows for BlackRock’s fund. This came after 71 days of daily inflows, which propelled IBIT above competing funds. Furthermore, ETF expert Eric Balchunas noted that the trend was not unusual on Wall Street. Totally normal, for example 78% of all ETFs saw $0 inflow yest. Extreme eg: $EEM has reported $0 inflows for like 150 days in a row while trading $80b worth of shares. Just means naturals balanced out or inflows and outflows were equal — Eric Balchunas (@EricBalchunas) April 25, 2024 Bitcoin undeterred by spot ETF outflow, post-halving price lull Per CoinMarketCap, Bitcoin traded under $61,000 at press time and had declined over 12% in the past month due to a market correction leading up to the halving. The broader cryptocurrency market has correlated with BTC price action, and altcoin valuations have stalled, with the total crypto market cap plunging below $2.3 trillion. Sideways crypto movement is not new following a halving, but speculations about the market’s status abound. Speaking with crypto.news, Storm Labs CEO Sunil Srivatsa said the bull run is on. “General consensus is that we’ve entered another bull…

What's Your Reaction?

![Writing the Ultimate One-Pager About Your Business: 8 Examples and How to Make One [+ Free Template]](https://blog.hubspot.com/hubfs/onepager-1.webp#keepProtocol)

![Return to Office? How Employees Are Feeling in 2024 [Data from 700+ Consumers]](https://blog.hubspot.com/hubfs/return-to-office_featured.webp#keepProtocol)

![Consumer Behavior Statistics You Should Know in 2024 [New Data]](https://blog.hubspot.com/hubfs/consumer-behavior-statistics.png#keepProtocol)