Bitcoin Whale Signal Echoes Pre-480% Surge In Mid-2020

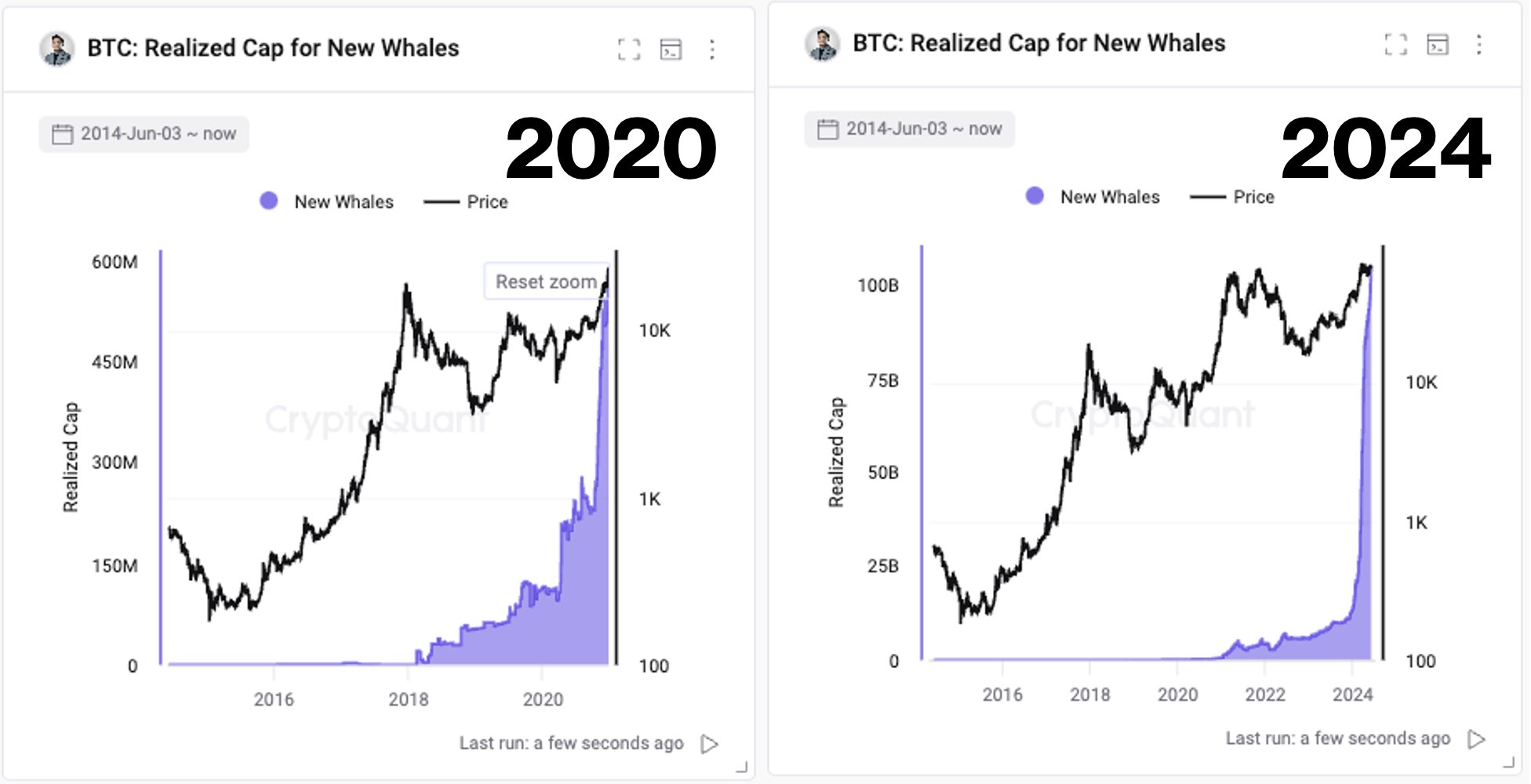

The post Bitcoin Whale Signal Echoes Pre-480% Surge In Mid-2020 appeared on BitcoinEthereumNews.com. CryptoQuant CEO Ki Young-Ju today pointed out significant similarities in Bitcoin’s market behavior between the current state and mid-2020, a period marked by stagnant prices but high on-chain activity. Young-Ju’s insights were illustrated with two key charts and shared via a post on X, drawing parallels that suggest a robust undercurrent of large volume transactions, potentially outside the public exchange networks. Bitcoin realized cap for new whales | Source: X @ki_young_ju The first chart, representing data up until 2020, shows Bitcoin’s price alongside the realized cap for new whales – a metric that tracks the aggregate value at which the newly acquired Bitcoin by large investors was last moved. It’s a different form of market capitalization that assesses each UTXO at the price it last changed hands, rather than its present market price. This metric reflects the actual realized value of all the coins in the network, rather than their current market value. Related Reading This value experienced a sharp increase around mid-2020, precisely when Bitcoin’s price was caught in boredom just like in recent months, consistently trading around the $10,000 mark. According to Young-Ju, this period was characterized by high on-chain activity which later analysis suggested involved over-the-counter (OTC) transactions among institutional players. In the second chart, extending to 2024, a similar pattern emerges with even more pronounced growth in the realized cap for new whales, despite Bitcoin’s price showing a sideways movement for almost 100 days now. The chart indicates a significant addition of about $1 billion daily into new whale wallets, a term typically referring to addresses holding large amounts of Bitcoin, often linked with institutional or highly capitalized individual investors. What This Means For Bitcoin Price Ki Young-Ju elaborated on these observations: “Same vibe on Bitcoin as mid-2020. Back then, BTC hovered around $10k for 6…

The post Bitcoin Whale Signal Echoes Pre-480% Surge In Mid-2020 appeared on BitcoinEthereumNews.com.

CryptoQuant CEO Ki Young-Ju today pointed out significant similarities in Bitcoin’s market behavior between the current state and mid-2020, a period marked by stagnant prices but high on-chain activity. Young-Ju’s insights were illustrated with two key charts and shared via a post on X, drawing parallels that suggest a robust undercurrent of large volume transactions, potentially outside the public exchange networks. Bitcoin realized cap for new whales | Source: X @ki_young_ju The first chart, representing data up until 2020, shows Bitcoin’s price alongside the realized cap for new whales – a metric that tracks the aggregate value at which the newly acquired Bitcoin by large investors was last moved. It’s a different form of market capitalization that assesses each UTXO at the price it last changed hands, rather than its present market price. This metric reflects the actual realized value of all the coins in the network, rather than their current market value. Related Reading This value experienced a sharp increase around mid-2020, precisely when Bitcoin’s price was caught in boredom just like in recent months, consistently trading around the $10,000 mark. According to Young-Ju, this period was characterized by high on-chain activity which later analysis suggested involved over-the-counter (OTC) transactions among institutional players. In the second chart, extending to 2024, a similar pattern emerges with even more pronounced growth in the realized cap for new whales, despite Bitcoin’s price showing a sideways movement for almost 100 days now. The chart indicates a significant addition of about $1 billion daily into new whale wallets, a term typically referring to addresses holding large amounts of Bitcoin, often linked with institutional or highly capitalized individual investors. What This Means For Bitcoin Price Ki Young-Ju elaborated on these observations: “Same vibe on Bitcoin as mid-2020. Back then, BTC hovered around $10k for 6…

What's Your Reaction?

.png)