Bitcoin Dips Below $62K Amid Disappointing Hong Kong ETF Debut

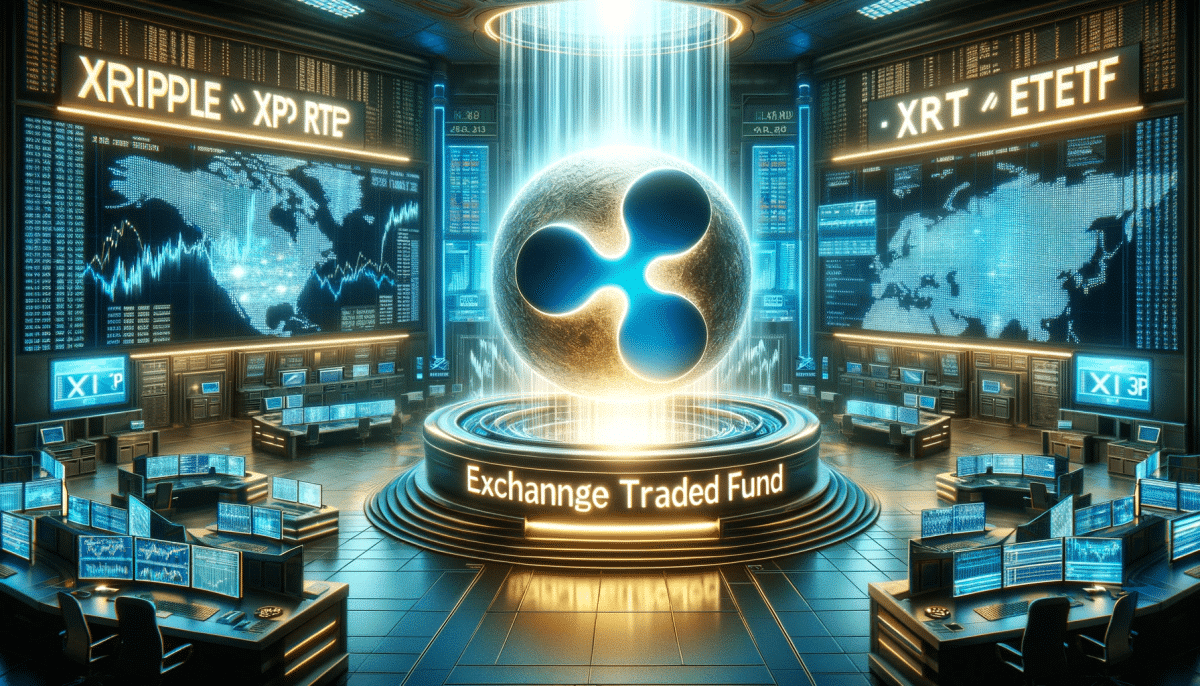

The post Bitcoin Dips Below $62K Amid Disappointing Hong Kong ETF Debut appeared on BitcoinEthereumNews.com. The launch of Hong Kong’s spot Bitcoin ETFs witnessed lackluster trading activity and disappointing expectations with a total volume of just $11 million. Amid challenges in China’s stock market and real estate sector, there’s optimism that Bitcoin ETFs could emerge as a favored investment option. The excitement around the launch of the Hong Kong spot Bitcoin ETFs finally fizzles out after a poor show on the very first day of trading, as reported by Crypto News Flash. Amid poor demand and trading activity, the Bitcoin price has come under strong selling pressure losing over 1.5% in the European market hours, now trading at $61,538 levels with a market cap of $1.213 trillion. The six ETFs that debuted on Tuesday in Hong Kong fell short of expectations, amassing a total trading volume of just $11 million, notably lower than the anticipated $100 million. Of this figure, Bitcoin ETFs comprised $8.5 million, with ether ETFs making up the remainder. Comparatively, this cumulative volume is substantially lower than the first-day trading volume of U.S.-based spot BTC ETFs, which amounted to $655 million. Since their introduction on January 11, nearly a dozen spot BTC ETFs in the U.S. have attracted close to $12 billion in investor capital. However, recent inflows have slowed, causing a pause in Bitcoin’s upward trajectory. On their inaugural day of trading, the new Bitcoin funds—Harvest Bitcoin Spot ETF (HGI BTC), Bosera Hashkey Bitcoin ETF (BOS HSK BTC), and ChinaAMC Bitcoin ETF (CAM BTC)—generated a combined turnover of $7.85 million by market close. ChinaAMC’s Bitcoin fund led the pack, commanding 57% of the total turnover among all Bitcoin ETFs on its debut. The Harvest ETF accounted for 29%, leaving the Bosera Hashkey fund with the remaining share. Similarly, among the three Ethereum funds introduced by the same issuers, the distribution of…

The post Bitcoin Dips Below $62K Amid Disappointing Hong Kong ETF Debut appeared on BitcoinEthereumNews.com.

The launch of Hong Kong’s spot Bitcoin ETFs witnessed lackluster trading activity and disappointing expectations with a total volume of just $11 million. Amid challenges in China’s stock market and real estate sector, there’s optimism that Bitcoin ETFs could emerge as a favored investment option. The excitement around the launch of the Hong Kong spot Bitcoin ETFs finally fizzles out after a poor show on the very first day of trading, as reported by Crypto News Flash. Amid poor demand and trading activity, the Bitcoin price has come under strong selling pressure losing over 1.5% in the European market hours, now trading at $61,538 levels with a market cap of $1.213 trillion. The six ETFs that debuted on Tuesday in Hong Kong fell short of expectations, amassing a total trading volume of just $11 million, notably lower than the anticipated $100 million. Of this figure, Bitcoin ETFs comprised $8.5 million, with ether ETFs making up the remainder. Comparatively, this cumulative volume is substantially lower than the first-day trading volume of U.S.-based spot BTC ETFs, which amounted to $655 million. Since their introduction on January 11, nearly a dozen spot BTC ETFs in the U.S. have attracted close to $12 billion in investor capital. However, recent inflows have slowed, causing a pause in Bitcoin’s upward trajectory. On their inaugural day of trading, the new Bitcoin funds—Harvest Bitcoin Spot ETF (HGI BTC), Bosera Hashkey Bitcoin ETF (BOS HSK BTC), and ChinaAMC Bitcoin ETF (CAM BTC)—generated a combined turnover of $7.85 million by market close. ChinaAMC’s Bitcoin fund led the pack, commanding 57% of the total turnover among all Bitcoin ETFs on its debut. The Harvest ETF accounted for 29%, leaving the Bosera Hashkey fund with the remaining share. Similarly, among the three Ethereum funds introduced by the same issuers, the distribution of…

What's Your Reaction?

![Writing the Ultimate One-Pager About Your Business: 8 Examples and How to Make One [+ Free Template]](https://blog.hubspot.com/hubfs/onepager-1.webp#keepProtocol)

![Return to Office? How Employees Are Feeling in 2024 [Data from 700+ Consumers]](https://blog.hubspot.com/hubfs/return-to-office_featured.webp#keepProtocol)

![Consumer Behavior Statistics You Should Know in 2024 [New Data]](https://blog.hubspot.com/hubfs/consumer-behavior-statistics.png#keepProtocol)