4 Key Reasons Why The Bitcoin Bull Run Is Far From Over

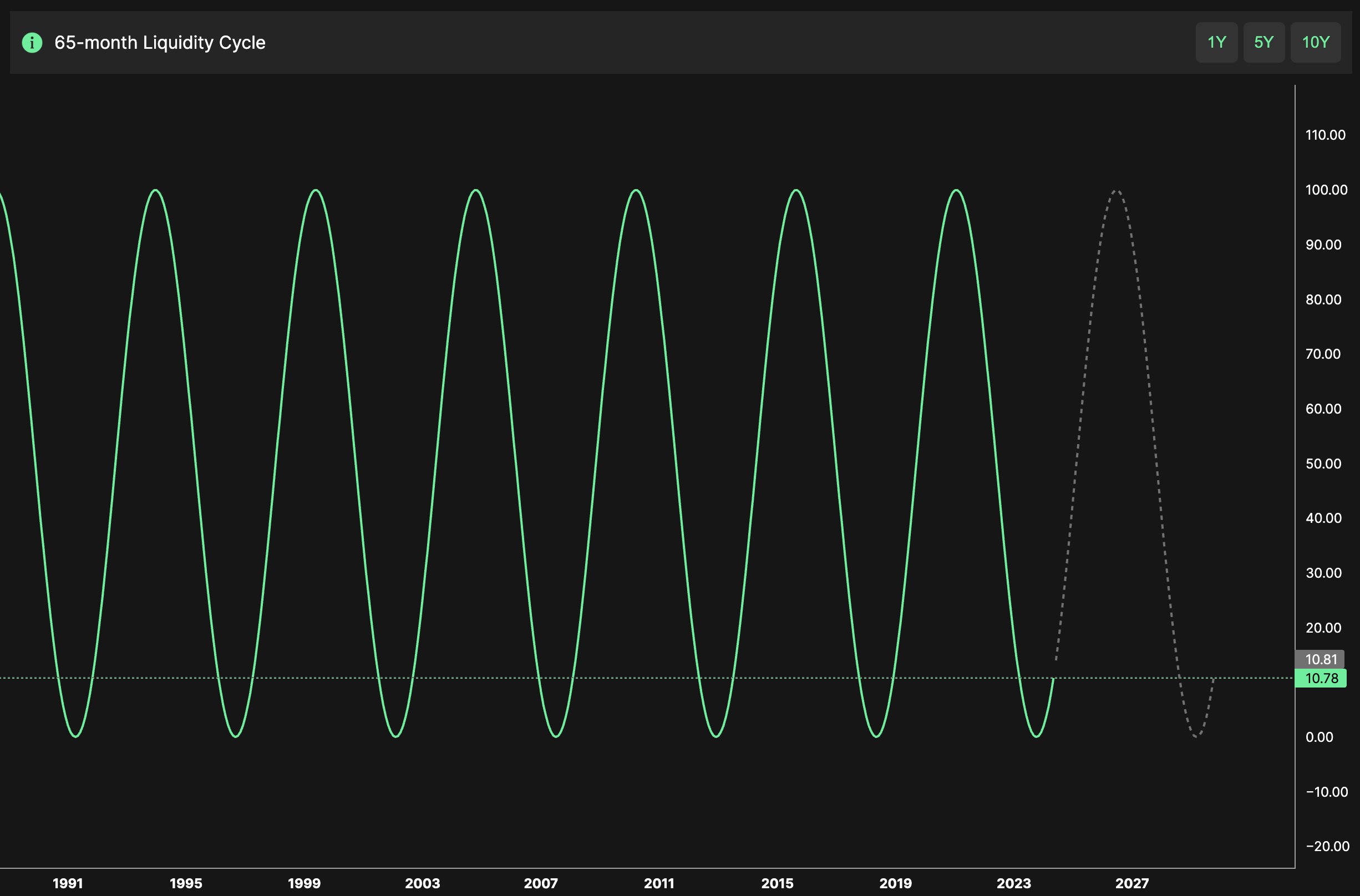

The post 4 Key Reasons Why The Bitcoin Bull Run Is Far From Over appeared on BitcoinEthereumNews.com. In an analysis shared via X, renowned crypto analyst Ted (@tedtalksmacro) has provided compelling evidence to support his assertion that the current Bitcoin bull run is far from over. Ted’s insights are based on four critical indicators related to traditional finance and crypto liquidity, each pointing to sustained growth in the near future. Here’s a breakdown of his analysis: #1 65-Month Liquidity Cycle Ted highlights the 65-month liquidity cycle, a historical pattern that marks the ebb and flow of liquidity in financial markets. According to his analysis, this cycle bottomed out in October 2023, signaling the beginning of a new expansion phase. “We are now in the expansion phase, which is expected to peak in 2026,” Ted stated. This projection aligns with the anticipated easing by central banks in response to slowing economic data over the next 18 to 24 months. Historically, increased liquidity has been a precursor to bull markets in various asset classes, including Bitcoin and the broader crypto ecosystem. 65 month liquidity cycle | Source: @tedtalksmacro #2 M2 Money Supply The M2 money supply, which includes cash, checking deposits, and easily convertible near money, is another crucial indicator, if not the most important indicator of global liquidity. Ted notes that the rate of expansion in the M2 money supply is at its lowest since the 1990s. “There is plenty of room to the upside for easing liquidity conditions,” he explained. As central banks potentially ease monetary policies to stimulate economies, increased M2 growth could lead to more capital flowing into risk assets like Bitcoin. M2 money supply | Source: @tedtalksmacro #3 Crypto Liquidity While liquidity has returned to the crypto markets, particularly with the introduction of spot Bitcoin ETFs, Ted points out that the velocity of inflows has not yet reached the levels seen at cycle tops.…

The post 4 Key Reasons Why The Bitcoin Bull Run Is Far From Over appeared on BitcoinEthereumNews.com.

In an analysis shared via X, renowned crypto analyst Ted (@tedtalksmacro) has provided compelling evidence to support his assertion that the current Bitcoin bull run is far from over. Ted’s insights are based on four critical indicators related to traditional finance and crypto liquidity, each pointing to sustained growth in the near future. Here’s a breakdown of his analysis: #1 65-Month Liquidity Cycle Ted highlights the 65-month liquidity cycle, a historical pattern that marks the ebb and flow of liquidity in financial markets. According to his analysis, this cycle bottomed out in October 2023, signaling the beginning of a new expansion phase. “We are now in the expansion phase, which is expected to peak in 2026,” Ted stated. This projection aligns with the anticipated easing by central banks in response to slowing economic data over the next 18 to 24 months. Historically, increased liquidity has been a precursor to bull markets in various asset classes, including Bitcoin and the broader crypto ecosystem. 65 month liquidity cycle | Source: @tedtalksmacro #2 M2 Money Supply The M2 money supply, which includes cash, checking deposits, and easily convertible near money, is another crucial indicator, if not the most important indicator of global liquidity. Ted notes that the rate of expansion in the M2 money supply is at its lowest since the 1990s. “There is plenty of room to the upside for easing liquidity conditions,” he explained. As central banks potentially ease monetary policies to stimulate economies, increased M2 growth could lead to more capital flowing into risk assets like Bitcoin. M2 money supply | Source: @tedtalksmacro #3 Crypto Liquidity While liquidity has returned to the crypto markets, particularly with the introduction of spot Bitcoin ETFs, Ted points out that the velocity of inflows has not yet reached the levels seen at cycle tops.…

What's Your Reaction?

.png)