US Parents are Increasingly Choosing Bitcoin for College Savings

The post US Parents are Increasingly Choosing Bitcoin for College Savings appeared on BitcoinEthereumNews.com. According to reports, more parents in the US are abandoning traditional 529 college savings plans in favor of Bitcoin. This shift stems from Bitcoin’s historical price appreciation, which has outpaced conventional investment options like stocks. Parents Identify Bitcoin’s Appeal as a Long-Term Investment Many of these parents view Bitcoin as a hedge against inflation and economic uncertainty, seeing its long-term growth potential as an advantage. Despite concerns about its volatility, these investors remain confident in Bitcoin’s ability to preserve value over time. Still, some parents view Bitcoin as a diversification strategy rather than a complete replacement for traditional savings plans. Many believe their children will have ample time to ride out Bitcoin market fluctuations before they need to access the funds for their College tuition. “If you’re saving for your kids, add Bitcoin to the portfolio. Buying $10-$100 of Bitcoin per month over 18 years will set your kids up for an excellent life. It will massively outperform the rest of the portfolio,” wrote Rajat Soni, a popular financier on X (formerly Twitter). Bitcoin’s recent price action has reinforced investor confidence. The cryptocurrency reached a new all-time high of nearly $110,000 this year, marking a staggering 500% surge from its 2022 low of under $20,000. Supporters argue that Bitcoin still holds significant growth potential, which has fueled its adoption across retail and institutional investors alike. However, choosing Bitcoin over 529 plans comes with trade-offs. While Bitcoin offers the potential for significant gains, parents who opt for cryptocurrency investments forego the tax advantages of 529 plans, which provide benefits like tax-free withdrawals for educational expenses. Growing Institutional and Political Support for BTC Meanwhile, Bitcoin’s rising adoption extends past individual investors. Over the past year, institutional interest has surged, with more than 70 publicly traded companies now holding over 600,000 BTC. This…

The post US Parents are Increasingly Choosing Bitcoin for College Savings appeared on BitcoinEthereumNews.com.

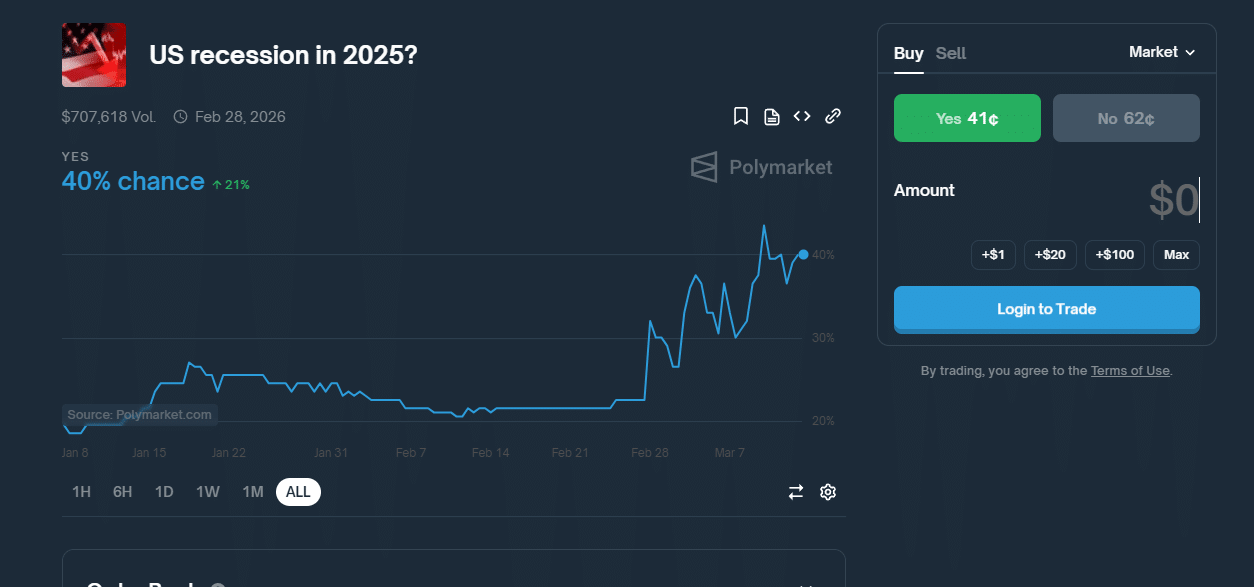

According to reports, more parents in the US are abandoning traditional 529 college savings plans in favor of Bitcoin. This shift stems from Bitcoin’s historical price appreciation, which has outpaced conventional investment options like stocks. Parents Identify Bitcoin’s Appeal as a Long-Term Investment Many of these parents view Bitcoin as a hedge against inflation and economic uncertainty, seeing its long-term growth potential as an advantage. Despite concerns about its volatility, these investors remain confident in Bitcoin’s ability to preserve value over time. Still, some parents view Bitcoin as a diversification strategy rather than a complete replacement for traditional savings plans. Many believe their children will have ample time to ride out Bitcoin market fluctuations before they need to access the funds for their College tuition. “If you’re saving for your kids, add Bitcoin to the portfolio. Buying $10-$100 of Bitcoin per month over 18 years will set your kids up for an excellent life. It will massively outperform the rest of the portfolio,” wrote Rajat Soni, a popular financier on X (formerly Twitter). Bitcoin’s recent price action has reinforced investor confidence. The cryptocurrency reached a new all-time high of nearly $110,000 this year, marking a staggering 500% surge from its 2022 low of under $20,000. Supporters argue that Bitcoin still holds significant growth potential, which has fueled its adoption across retail and institutional investors alike. However, choosing Bitcoin over 529 plans comes with trade-offs. While Bitcoin offers the potential for significant gains, parents who opt for cryptocurrency investments forego the tax advantages of 529 plans, which provide benefits like tax-free withdrawals for educational expenses. Growing Institutional and Political Support for BTC Meanwhile, Bitcoin’s rising adoption extends past individual investors. Over the past year, institutional interest has surged, with more than 70 publicly traded companies now holding over 600,000 BTC. This…

What's Your Reaction?

![The 12 Best Free Flowchart Templates [+ Examples]](https://www.hubspot.com/hubfs/free-flowchart-template-1-20240716-6679104-1.webp)

![Top Marketing Channels in 2025 — Here’s What Your Team Needs to Master [Data]](https://www.hubspot.com/hubfs/marketing%20channel.png)

.png)