Uniswap Thrives with $3.7 Billion in Fees and Expands Multichain

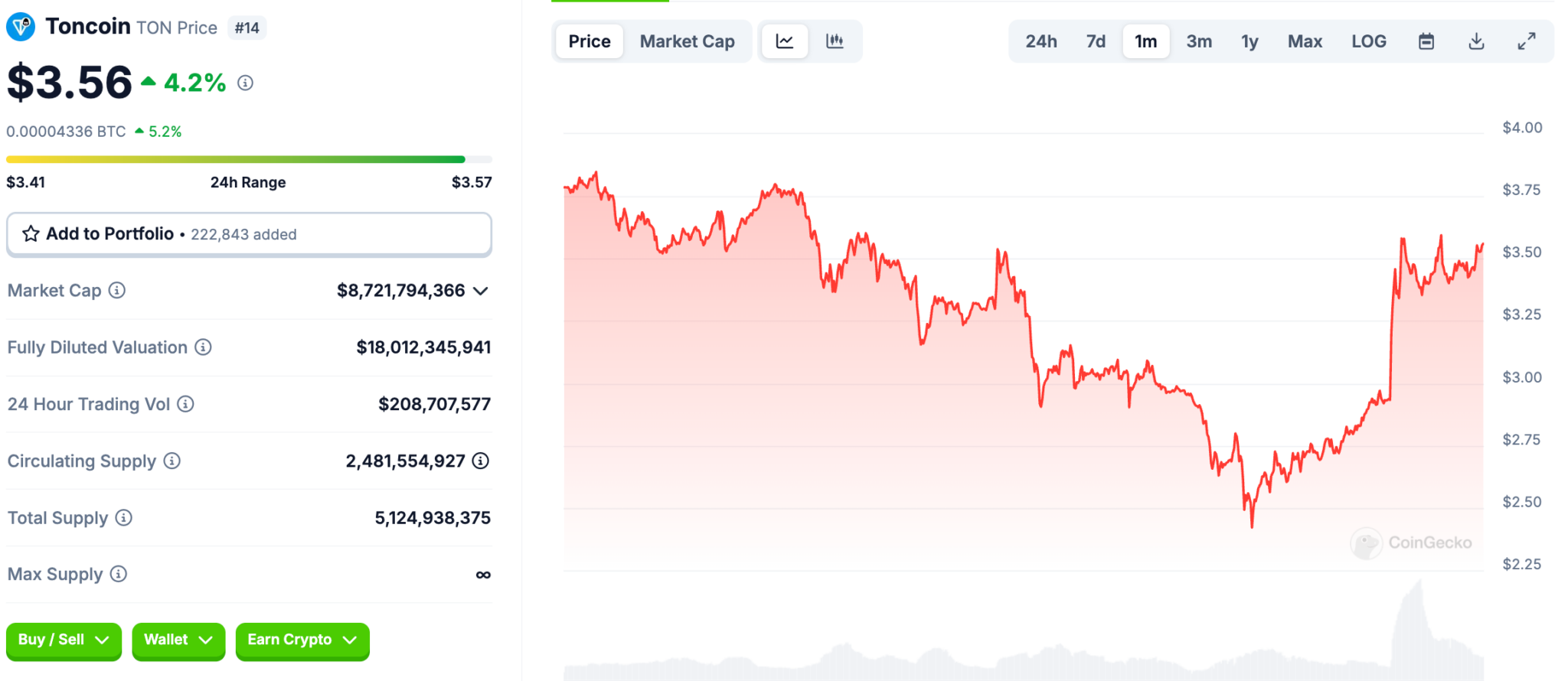

The post Uniswap Thrives with $3.7 Billion in Fees and Expands Multichain appeared on BitcoinEthereumNews.com. Uniswap liquidity providers have earned $3.7 billion in trading fees, showcasing the platform’s thriving decentralized finance ecosystem. Uniswap’s expansion across multiple chains has significantly boosted its active user base and trading activity, particularly on Base. Uniswap continues to prove its dominance in the decentralized finance (DeFi) market by significant financial milestones. Token Terminal statistics show that platform liquidity providers have earned $3.7 billion in trading fees overall, ample evidence of the platform’s vibrant activity. Layer 1 and Layer 2 networks have paid $2.7 billion in gas fees. This emphasizes the increasing desire for distributed trading in spite of somewhat expensive blockchain running expenses. Uniswap Labs has also paid trade fees totaling $62.6 million, but the Uniswap DAO, which runs the protocol, has not yet paid any fees. This special structure highlights the governance paradigm whereby fees are mostly directed to liquidity providers and the platform instead of the DAO, therefore posing issues regarding future distribution and governance choices. An overview of @Uniswap‘s economics to date: 1. Trading fees paid to LPs: $3.7b2. Gas fees paid to L1 & L2: $2.7b3. Trading fees paid to Uniswap Labs: $62.6m4. Trading fees paid to Uniswap DAO: $0 pic.twitter.com/hNT5Rfudyv — Token Terminal (@tokenterminal) October 20, 2024 Uniswap Multichain Model Drives User Growth and Fee Distribution Uniswap’s impact keeps increasing as it spreads over other chains, including Ethereum and Base. By allowing it to serve a larger user base, this multichain model has helped it to boost transaction volumes and user interaction over multiple networks. While the recently introduced Base chain has rapidly expanded to account for around 20% of total fees in a few months, Ethereum remains the dominant chain, producing around 70% of the total revenue. Furthermore, with a varied distribution among chains, Uniswap is making notable progress in the monthly active users.…

The post Uniswap Thrives with $3.7 Billion in Fees and Expands Multichain appeared on BitcoinEthereumNews.com.

Uniswap liquidity providers have earned $3.7 billion in trading fees, showcasing the platform’s thriving decentralized finance ecosystem. Uniswap’s expansion across multiple chains has significantly boosted its active user base and trading activity, particularly on Base. Uniswap continues to prove its dominance in the decentralized finance (DeFi) market by significant financial milestones. Token Terminal statistics show that platform liquidity providers have earned $3.7 billion in trading fees overall, ample evidence of the platform’s vibrant activity. Layer 1 and Layer 2 networks have paid $2.7 billion in gas fees. This emphasizes the increasing desire for distributed trading in spite of somewhat expensive blockchain running expenses. Uniswap Labs has also paid trade fees totaling $62.6 million, but the Uniswap DAO, which runs the protocol, has not yet paid any fees. This special structure highlights the governance paradigm whereby fees are mostly directed to liquidity providers and the platform instead of the DAO, therefore posing issues regarding future distribution and governance choices. An overview of @Uniswap‘s economics to date: 1. Trading fees paid to LPs: $3.7b2. Gas fees paid to L1 & L2: $2.7b3. Trading fees paid to Uniswap Labs: $62.6m4. Trading fees paid to Uniswap DAO: $0 pic.twitter.com/hNT5Rfudyv — Token Terminal (@tokenterminal) October 20, 2024 Uniswap Multichain Model Drives User Growth and Fee Distribution Uniswap’s impact keeps increasing as it spreads over other chains, including Ethereum and Base. By allowing it to serve a larger user base, this multichain model has helped it to boost transaction volumes and user interaction over multiple networks. While the recently introduced Base chain has rapidly expanded to account for around 20% of total fees in a few months, Ethereum remains the dominant chain, producing around 70% of the total revenue. Furthermore, with a varied distribution among chains, Uniswap is making notable progress in the monthly active users.…

What's Your Reaction?

![13 YouTube Description Templates That Have Helped Our Videos Go Viral [+ Examples]](https://www.hubspot.com/hubfs/youtube-description-template_8.webp)

.png)