Tokenized deposits unlock payment efficiency, reduce settlement risk: Visa

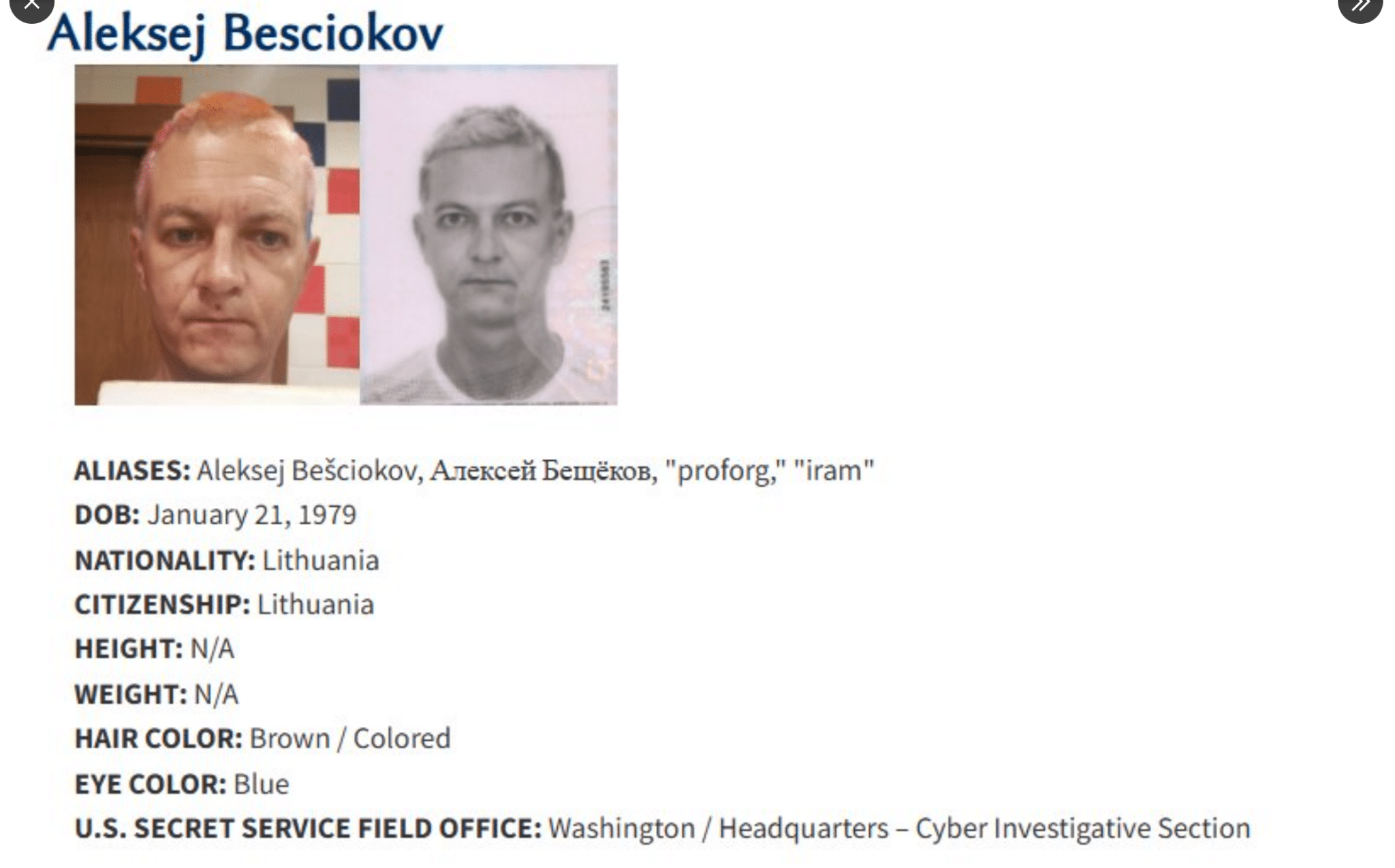

The post Tokenized deposits unlock payment efficiency, reduce settlement risk: Visa appeared on BitcoinEthereumNews.com. In November 2023, Visa (NASDAQ: V) completed a trial on tokenized deposits in Hong Kong. The payments giant had partnered with HSBC (NASDAQ: HSBC) and Hang Seng Bank (NASDAQ: HSNGF) on the pilot, which also experimented with the use of the e-HKD for interbank settlements. It has now published a report detailing the trial, and it says that tokenized deposits can unlock payment efficiency, enhance transparency and reduce settlement risk. In its trial, Visa focused on two use cases—purchase of high-value property and acquirer-to-merchant card settlement. With the former, Visa designed a purchase process that leveraged smart contracts to enable real-time funds settlement. It cut down the time taken for such transactions from days to seconds, with the property developer being a Hang Seng Bank client while the buyer banked with HSBC. The transaction was settled in the proposed Hong Kong digital dollar (e-HKD). The use of blockchain offered enhanced transparency, with its immutable ledger providing a tamper-proof audit trail. The second proposed use case focused on acquirer-merchant card settlements. In this case, Visa’s tokenization solution, coupled with smart contracts, reduced the time an acquirer takes to process card payments from hours to seconds. Visa found enhanced transaction speed and reduced costs to be some of the key benefits. In the pilot, tokenized deposits were burned on Hang Seng’s ledger and minted on HSBC’s ledger as the e-HKD simultaneously moved on the central bank’s ledger. Atomic settlements, where the minting, burning and central bank digital currency (CBDC) settlements all happened simultaneously, eliminate settlement risk. Real-time payments improve banks’ liquidity by reducing collateral requirements. The 24/7 availability of tokenized deposits and blockchain-enhanced privacy were cited as the other benefits. On challenges, Visa cited a lack of interoperability with existing systems and low standardization. It also called for further evaluation to test…

The post Tokenized deposits unlock payment efficiency, reduce settlement risk: Visa appeared on BitcoinEthereumNews.com.

In November 2023, Visa (NASDAQ: V) completed a trial on tokenized deposits in Hong Kong. The payments giant had partnered with HSBC (NASDAQ: HSBC) and Hang Seng Bank (NASDAQ: HSNGF) on the pilot, which also experimented with the use of the e-HKD for interbank settlements. It has now published a report detailing the trial, and it says that tokenized deposits can unlock payment efficiency, enhance transparency and reduce settlement risk. In its trial, Visa focused on two use cases—purchase of high-value property and acquirer-to-merchant card settlement. With the former, Visa designed a purchase process that leveraged smart contracts to enable real-time funds settlement. It cut down the time taken for such transactions from days to seconds, with the property developer being a Hang Seng Bank client while the buyer banked with HSBC. The transaction was settled in the proposed Hong Kong digital dollar (e-HKD). The use of blockchain offered enhanced transparency, with its immutable ledger providing a tamper-proof audit trail. The second proposed use case focused on acquirer-merchant card settlements. In this case, Visa’s tokenization solution, coupled with smart contracts, reduced the time an acquirer takes to process card payments from hours to seconds. Visa found enhanced transaction speed and reduced costs to be some of the key benefits. In the pilot, tokenized deposits were burned on Hang Seng’s ledger and minted on HSBC’s ledger as the e-HKD simultaneously moved on the central bank’s ledger. Atomic settlements, where the minting, burning and central bank digital currency (CBDC) settlements all happened simultaneously, eliminate settlement risk. Real-time payments improve banks’ liquidity by reducing collateral requirements. The 24/7 availability of tokenized deposits and blockchain-enhanced privacy were cited as the other benefits. On challenges, Visa cited a lack of interoperability with existing systems and low standardization. It also called for further evaluation to test…

What's Your Reaction?

![The 12 Best Free Flowchart Templates [+ Examples]](https://www.hubspot.com/hubfs/free-flowchart-template-1-20240716-6679104-1.webp)

![Top Marketing Channels in 2025 — Here’s What Your Team Needs to Master [Data]](https://www.hubspot.com/hubfs/marketing%20channel.png)

.png)