How LI.FI Bridges the Liquidity Gap in Crypto

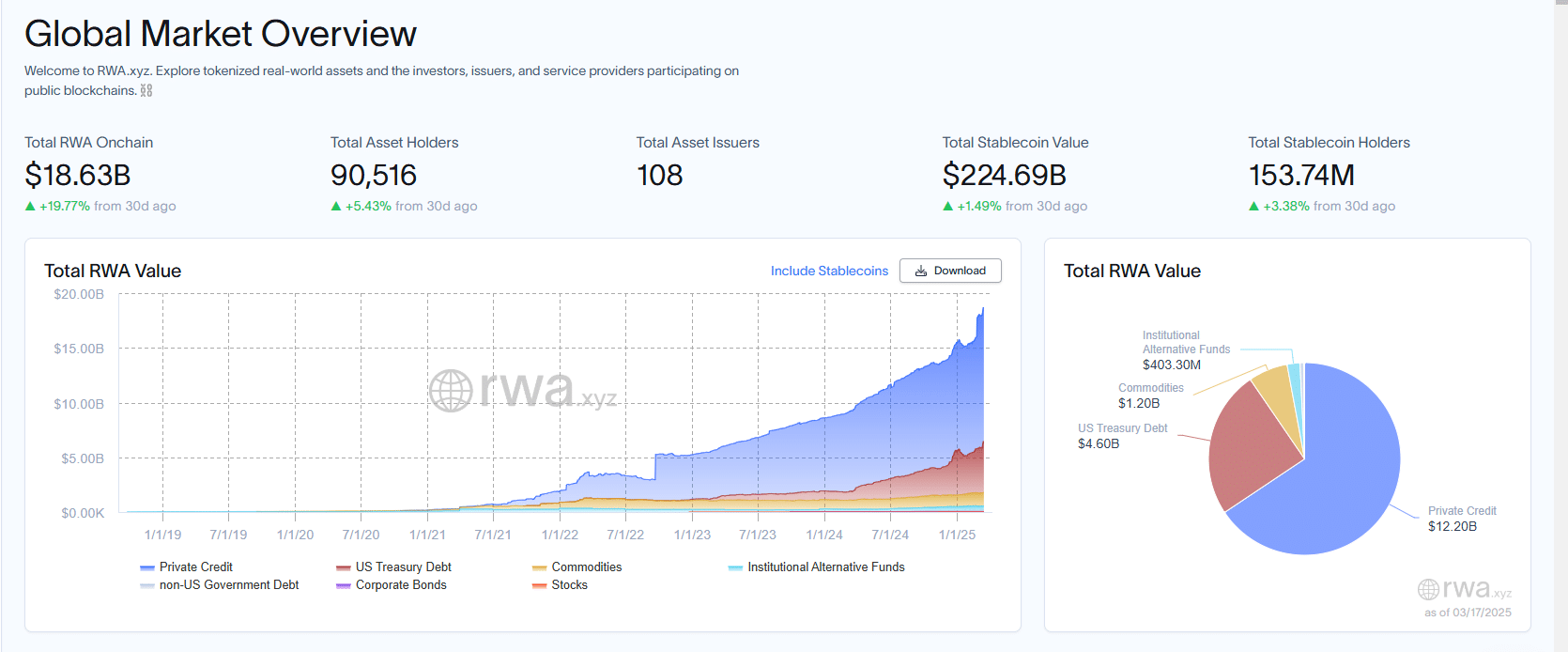

The post How LI.FI Bridges the Liquidity Gap in Crypto appeared on BitcoinEthereumNews.com. As of writing this, the total value locked (TVL) in DeFi has surged to $80.2 billion, nearly doubling from last year’s $39 billion. While this signals growing adoption and a flood of projects moving on-chain, it also brings increased complexity. Users are finding it harder to transfer assets between chains, while projects struggle to attract users beyond their native ecosystems. Liquidity is scattered, and managing assets across chains and applications has become a serious challenge. In this blog, we’ll dive into the key issues of fragmented liquidity, complicated asset transfers, and integration challenges for developers — and how LI.FI makes the DeFi experience better. Solving DeFi Fragmentation As DeFi continues to evolve, the ecosystem faces several key challenges, from fragmented liquidity to complex user experiences and developer integration headaches. Let’s understand each challenge and how LI.FI helps overcome it: 1. Fragmented Liquidity Across Chains The increase in the number of chains has spread liquidity across different apps and chains. This makes it harder for users and developers to find the best rates or access the most efficient liquidity. With liquidity scattered, there’s often higher slippage, suboptimal trading conditions, and more manual work to connect to each liquidity source. Via Defillama To solve this, LI.FI aggregates liquidity from over 30+ chains, 18+ bridges, and 38+ DEXs and DEX aggregators into a single platform. Instead of manually navigating fragmented liquidity, users and developers can access everything they need from one place. This means better prices, lower slippage, and smoother transactions without having to deal with the complexity of multiple integrations. 2. Complex User Experience in Multi-Chain Transactions Interacting across chains can be a frustrating experience for users. Swapping, bridging, or moving assets typically requires multiple steps and different tools, which makes the process slow and confusing. This complexity discourages users from engaging…

The post How LI.FI Bridges the Liquidity Gap in Crypto appeared on BitcoinEthereumNews.com.

As of writing this, the total value locked (TVL) in DeFi has surged to $80.2 billion, nearly doubling from last year’s $39 billion. While this signals growing adoption and a flood of projects moving on-chain, it also brings increased complexity. Users are finding it harder to transfer assets between chains, while projects struggle to attract users beyond their native ecosystems. Liquidity is scattered, and managing assets across chains and applications has become a serious challenge. In this blog, we’ll dive into the key issues of fragmented liquidity, complicated asset transfers, and integration challenges for developers — and how LI.FI makes the DeFi experience better. Solving DeFi Fragmentation As DeFi continues to evolve, the ecosystem faces several key challenges, from fragmented liquidity to complex user experiences and developer integration headaches. Let’s understand each challenge and how LI.FI helps overcome it: 1. Fragmented Liquidity Across Chains The increase in the number of chains has spread liquidity across different apps and chains. This makes it harder for users and developers to find the best rates or access the most efficient liquidity. With liquidity scattered, there’s often higher slippage, suboptimal trading conditions, and more manual work to connect to each liquidity source. Via Defillama To solve this, LI.FI aggregates liquidity from over 30+ chains, 18+ bridges, and 38+ DEXs and DEX aggregators into a single platform. Instead of manually navigating fragmented liquidity, users and developers can access everything they need from one place. This means better prices, lower slippage, and smoother transactions without having to deal with the complexity of multiple integrations. 2. Complex User Experience in Multi-Chain Transactions Interacting across chains can be a frustrating experience for users. Swapping, bridging, or moving assets typically requires multiple steps and different tools, which makes the process slow and confusing. This complexity discourages users from engaging…

What's Your Reaction?

.png)