Bitcoin Price Slides Below $80K—Is A Bounce Back To $90K Possible?

The post Bitcoin Price Slides Below $80K—Is A Bounce Back To $90K Possible? appeared on BitcoinEthereumNews.com. Bitcoin (BTC) price extended its losses on March 10, dropping below $82,000 as traders reacted to fresh bearish signals. The cryptocurrency has now declined 25% from its all-time high, fueling concerns over further downside risks. Veteran trader Peter Brandt highlighted Bitcoin’s bearish outlook, citing a completed double-top pattern. The formation, which first developed in December, has now confirmed a breakdown, reinforcing a negative sentiment in the market. “Bitcoin has completed a classic double-top pattern,” Brandt noted. “The price must reclaim the high $90,000s to turn positive again.” Market Sentiment Shifts as Whales Accumulate 5,000 BTC While Bitcoin’s price action remains weak, on-chain data suggests potential accumulation. Santiment reported that wallets holding 10 or more BTC have added nearly 5,000 BTC since March 3. This shift follows weeks of selling pressure, which contributed to the recent correction. Bitcoin whales accumulate as retail traders panic. Source: Santiment/X “Bitcoin’s whale and shark wallets have gone through several key turning points over the past six months,” Santiment stated. “Recent accumulation could set the stage for a stronger second half of March.” Despite this trend, Bitcoin’s price has yet to react, leaving uncertainty about whether accumulation will translate into a reversal. BTC’s Next Move Could be Determined by Key Resistance at $90K Technical analysts remain divided on Bitcoin’s next direction. Captain Faibik, a crypto trader, suggested that BTC could attempt to reclaim $90,000 in the coming days. Source: Captain Faibik/X “$BTC is set to bounce back and could test the $90K crucial resistance this week,” he posted on X. However, the broader macroeconomic landscape continues to weigh on Bitcoin. Uncertainty surrounding President Donald Trump’s tariff policies and geopolitical tensions have contributed to risk-off sentiment across global markets. If BTC fails to reclaim $90,000, Arthur Hayes warns that further losses could follow. The BitMEX co-founder expects a retest…

The post Bitcoin Price Slides Below $80K—Is A Bounce Back To $90K Possible? appeared on BitcoinEthereumNews.com.

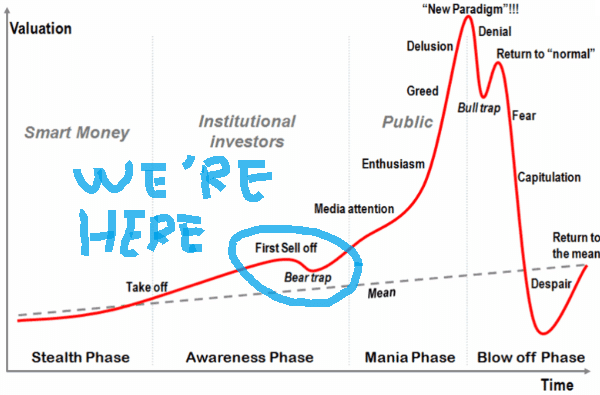

Bitcoin (BTC) price extended its losses on March 10, dropping below $82,000 as traders reacted to fresh bearish signals. The cryptocurrency has now declined 25% from its all-time high, fueling concerns over further downside risks. Veteran trader Peter Brandt highlighted Bitcoin’s bearish outlook, citing a completed double-top pattern. The formation, which first developed in December, has now confirmed a breakdown, reinforcing a negative sentiment in the market. “Bitcoin has completed a classic double-top pattern,” Brandt noted. “The price must reclaim the high $90,000s to turn positive again.” Market Sentiment Shifts as Whales Accumulate 5,000 BTC While Bitcoin’s price action remains weak, on-chain data suggests potential accumulation. Santiment reported that wallets holding 10 or more BTC have added nearly 5,000 BTC since March 3. This shift follows weeks of selling pressure, which contributed to the recent correction. Bitcoin whales accumulate as retail traders panic. Source: Santiment/X “Bitcoin’s whale and shark wallets have gone through several key turning points over the past six months,” Santiment stated. “Recent accumulation could set the stage for a stronger second half of March.” Despite this trend, Bitcoin’s price has yet to react, leaving uncertainty about whether accumulation will translate into a reversal. BTC’s Next Move Could be Determined by Key Resistance at $90K Technical analysts remain divided on Bitcoin’s next direction. Captain Faibik, a crypto trader, suggested that BTC could attempt to reclaim $90,000 in the coming days. Source: Captain Faibik/X “$BTC is set to bounce back and could test the $90K crucial resistance this week,” he posted on X. However, the broader macroeconomic landscape continues to weigh on Bitcoin. Uncertainty surrounding President Donald Trump’s tariff policies and geopolitical tensions have contributed to risk-off sentiment across global markets. If BTC fails to reclaim $90,000, Arthur Hayes warns that further losses could follow. The BitMEX co-founder expects a retest…

What's Your Reaction?

![How Marketers Can Use Retail Media Networks to Get In Front of Customers [Expert Tips]](https://www.hubspot.com/hubfs/retail%20media%20networks-hero%20%28598%20x%20398%20px%29.webp)

.png)