Archax leverages blockchain to offer tokenized funds from State Street, Fidelity, and LGIM

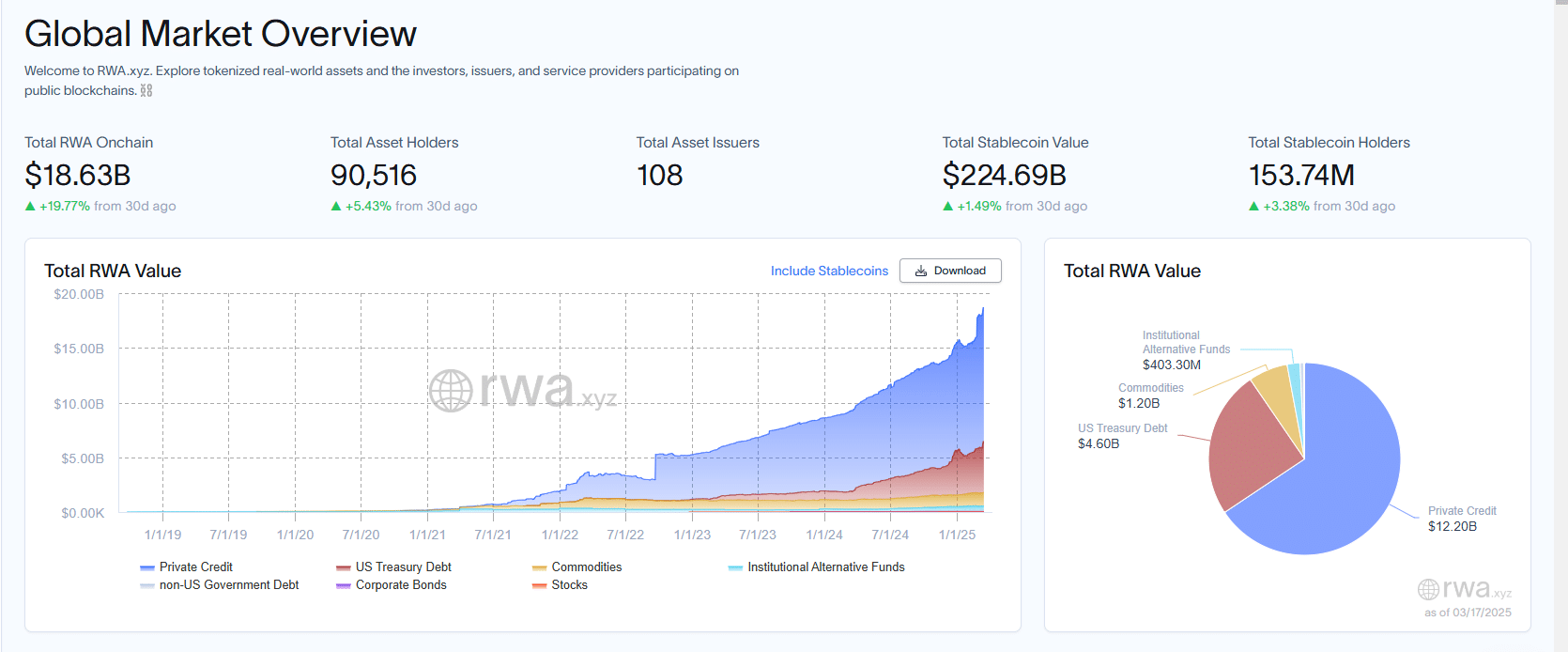

The post Archax leverages blockchain to offer tokenized funds from State Street, Fidelity, and LGIM appeared on BitcoinEthereumNews.com. Archax announced that it was expanding its tokenized RWA offerings to include industry leaders State Street, Fidelity, and LGIM money-market funds. The tokenized funds will be offered through beneficial ownership tokens that Archax will mint and offer. The UK-based digital asset platform hinted that they were likely to expand and include more fund offerings in the near future. The FCA-regulated firm said providing digital representations of MMFs was becoming a popular use case for tokenization and blockchain technology. Archax claimed that it opened up historically inaccessible yield-bearing products such as stablecoin holders or FinTechs holding cash reserves. Archax partners with industry giants to tokenize MMfs for greater accessibility Excited to announce the addition of @StateStreetGA, @Fidelity_UK and @LGIM to the range of funds available on our tokenised #realworldasset platform. The tokenised funds will initially be available on @hedera , @Ripple and @arbitrum. Read more here: https://t.co/urIvWGZYBJ pic.twitter.com/aXwMNRW1l4 — Archax (@ArchaxEx) November 20, 2024 The UK-based digital asset platform announced a significant expansion of its real-world asset (RWA) offerings. Archax integrated investment products from industry giants State Street Global Advisors, Fidelity International, and Legal & General Investment Management (LGIM). The platform said the partnership aimed at democratizing finance and providing accessible investment opportunities to a wider range of investors. Archax emphasized that it would initially focus on tokenizing MMFs from the three major asset managers. It would then use this innovative approach to unlock new opportunities for individual and institutional investors. “We are really pleased to be expanding our offerings by working with blue-chip industry leaders and are excited to be adding the State Street Global Advisors, Fidelity International and LGIM names to our growing list of partners.” – Graham Rodford Archax revealed that the State Street USD/GBP/EUR Liquidity LVNAV Funds, the Fidelity ILF USD/Sterling/Euro Funds, and the LGIM USD/Sterling/Euro Liquidity…

The post Archax leverages blockchain to offer tokenized funds from State Street, Fidelity, and LGIM appeared on BitcoinEthereumNews.com.

Archax announced that it was expanding its tokenized RWA offerings to include industry leaders State Street, Fidelity, and LGIM money-market funds. The tokenized funds will be offered through beneficial ownership tokens that Archax will mint and offer. The UK-based digital asset platform hinted that they were likely to expand and include more fund offerings in the near future. The FCA-regulated firm said providing digital representations of MMFs was becoming a popular use case for tokenization and blockchain technology. Archax claimed that it opened up historically inaccessible yield-bearing products such as stablecoin holders or FinTechs holding cash reserves. Archax partners with industry giants to tokenize MMfs for greater accessibility Excited to announce the addition of @StateStreetGA, @Fidelity_UK and @LGIM to the range of funds available on our tokenised #realworldasset platform. The tokenised funds will initially be available on @hedera , @Ripple and @arbitrum. Read more here: https://t.co/urIvWGZYBJ pic.twitter.com/aXwMNRW1l4 — Archax (@ArchaxEx) November 20, 2024 The UK-based digital asset platform announced a significant expansion of its real-world asset (RWA) offerings. Archax integrated investment products from industry giants State Street Global Advisors, Fidelity International, and Legal & General Investment Management (LGIM). The platform said the partnership aimed at democratizing finance and providing accessible investment opportunities to a wider range of investors. Archax emphasized that it would initially focus on tokenizing MMFs from the three major asset managers. It would then use this innovative approach to unlock new opportunities for individual and institutional investors. “We are really pleased to be expanding our offerings by working with blue-chip industry leaders and are excited to be adding the State Street Global Advisors, Fidelity International and LGIM names to our growing list of partners.” – Graham Rodford Archax revealed that the State Street USD/GBP/EUR Liquidity LVNAV Funds, the Fidelity ILF USD/Sterling/Euro Funds, and the LGIM USD/Sterling/Euro Liquidity…

What's Your Reaction?

.png)