$5.55 Billion Crypto Liquidations in April: Lessons to Learn

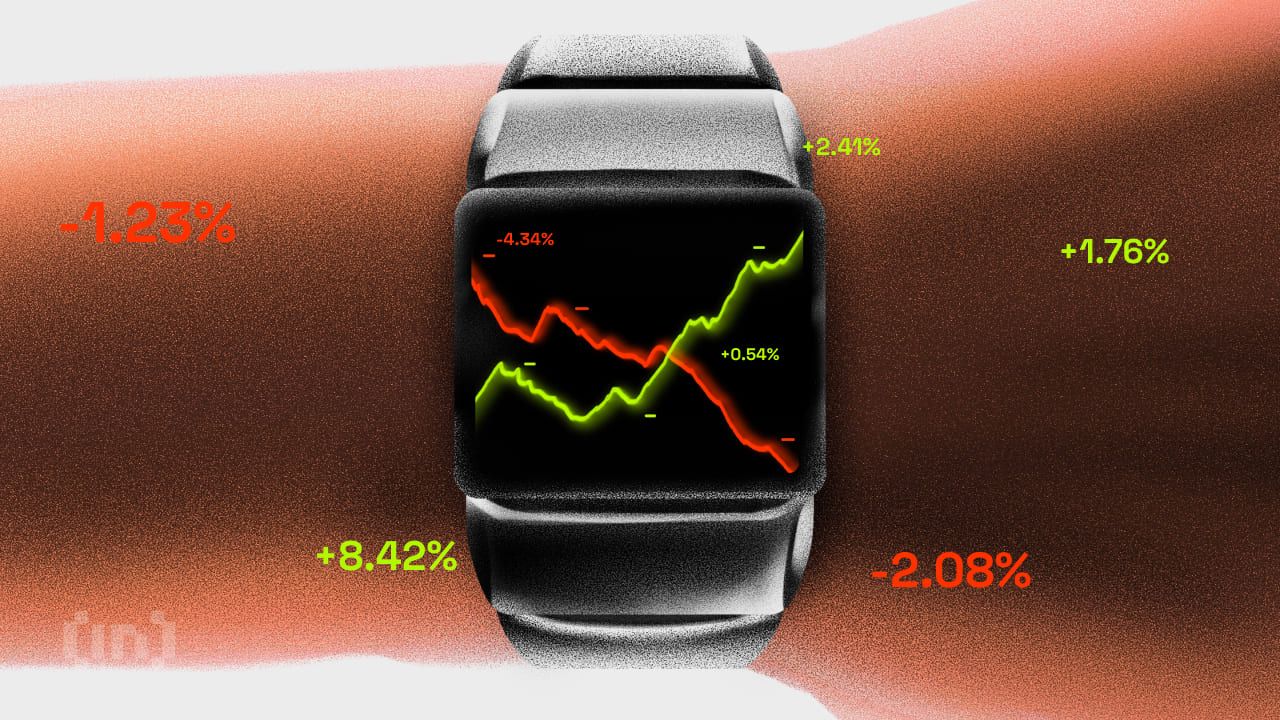

The post $5.55 Billion Crypto Liquidations in April: Lessons to Learn appeared on BitcoinEthereumNews.com. In an extraordinary display of market volatility, the cryptocurrency market saw a staggering $5.55 billion in long and short positions liquidated this April. This was primarily triggered by the mounting speculation around the Bitcoin halving event. This tumultuous period serves as a fertile ground for crucial insights and strategic adaptations in investment practices. Volatility Strikes Pre-Bitcoin Halving Rossmarie Davila, a seasoned crypto financial advisor, gave BeInCrypto insights into the best practices for navigating these turbulent times. When constructing an investment portfolio, she suggests having a clear objective for each asset on a short and long-term basis. Davila highlights the importance of a well-defined strategy as Bitcoin’s inherent volatility demands a nuanced approach. Indeed, this year’s halving has already significantly influenced Bitcoin’s market, driving prices to an all-time peak of $73,737 in March. However, the subsequent weeks brought volatility, with Bitcoin experiencing a sharp 20% price correction and some altcoins plummeting by over 70%. Given the high volatility, Davila strongly advises newcomers to the cryptocurrency market to proceed with caution. “The best thing to do is not to panic and rush out to buy like crazy, because Bitcoin is volatile. I think a good advice is to allocate a fixed amount each month and buy at the average price, and in the meantime, see how you feel about these highly volatile investments. With a clear strategy, market noise should not cause me anxiety,” Davila told BeInCrypto. Read more: Crypto Portfolio Management: A Beginner’s Guide Crypto Capital Flows. Source: Glassnode She also notes the psychological dynamics at play, particularly post-halving. The reduced Bitcoin supply invariably leads to price increases due to demand — classic supply and demand dynamics. If an investment portfolio aligns with expectations, it is recommendable to maintain one’s course. Otherwise, Davila suggests investors should consider reallocating or increasing holdings…

The post $5.55 Billion Crypto Liquidations in April: Lessons to Learn appeared on BitcoinEthereumNews.com.

In an extraordinary display of market volatility, the cryptocurrency market saw a staggering $5.55 billion in long and short positions liquidated this April. This was primarily triggered by the mounting speculation around the Bitcoin halving event. This tumultuous period serves as a fertile ground for crucial insights and strategic adaptations in investment practices. Volatility Strikes Pre-Bitcoin Halving Rossmarie Davila, a seasoned crypto financial advisor, gave BeInCrypto insights into the best practices for navigating these turbulent times. When constructing an investment portfolio, she suggests having a clear objective for each asset on a short and long-term basis. Davila highlights the importance of a well-defined strategy as Bitcoin’s inherent volatility demands a nuanced approach. Indeed, this year’s halving has already significantly influenced Bitcoin’s market, driving prices to an all-time peak of $73,737 in March. However, the subsequent weeks brought volatility, with Bitcoin experiencing a sharp 20% price correction and some altcoins plummeting by over 70%. Given the high volatility, Davila strongly advises newcomers to the cryptocurrency market to proceed with caution. “The best thing to do is not to panic and rush out to buy like crazy, because Bitcoin is volatile. I think a good advice is to allocate a fixed amount each month and buy at the average price, and in the meantime, see how you feel about these highly volatile investments. With a clear strategy, market noise should not cause me anxiety,” Davila told BeInCrypto. Read more: Crypto Portfolio Management: A Beginner’s Guide Crypto Capital Flows. Source: Glassnode She also notes the psychological dynamics at play, particularly post-halving. The reduced Bitcoin supply invariably leads to price increases due to demand — classic supply and demand dynamics. If an investment portfolio aligns with expectations, it is recommendable to maintain one’s course. Otherwise, Davila suggests investors should consider reallocating or increasing holdings…

What's Your Reaction?